impossible foods ipo australia

Consent is not a condition of purchase. How can I intern with you.

3 Ways Questionable Claims Hurt The Plant Based Foods Cause

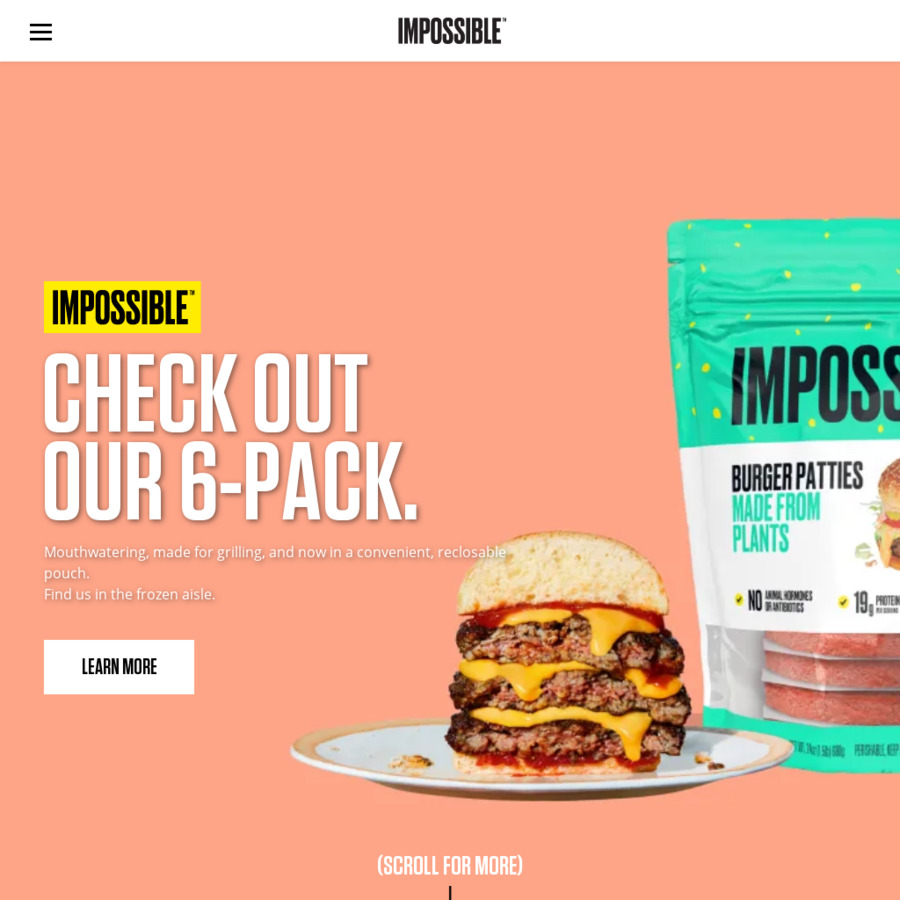

Impossible Foods is a plant-based meat manufacturer or agri-food startup which uses molecular research to create realistic substitutes for meat dairy and fish.

. Buy Impossible Foods Stock in the Initial Public Offering IPO Attempt to Acquire Impossible Foods Stock in Pre-IPO Secondary Marketplaces. Impossible Foods is an alt-meat company planning to foray into the Australian and New Zealand market. IMPOSSIBLE FOODS HIRES VANDERBILT UNIVERSITY BIOCHEMISTRY DEPARTMENT CHAIR DR.

What is Impossible Foods. It wont be before the end of the year and it may not be until the tail end of the recent food IPO. View Impossible Foods stock share price financials funding rounds investors and more at Craft.

He islike the companys target customera self-described hard-core meat eater. What is the science behind Impossible Foods. Please send me emails about Impossible Foods products and services.

The announcement comes amidst rumors of the companys USD 10 billion IPO plans via a SPAC special purpose acquisition company merger. Impossible Foods is set on going public. Impossible Foods has raised 137 b in total funding.

Dacmo on 17112021 -. Buy Impossible Foods After the Impossible Foods IPO. YORK AS CHIEF SCIENCE OFFICER.

WeWork wound up being exposed as junk before its IPO. In April 2021 sources close to the company reported that an Impossible Foods IPO was likely to occur in. July 14 2020 345 pm By JD Alois.

Brown will remain on Impossibles board and take up the new post of chief visionary officer in which he. As Impossible Foods readies itself for a reported 10 billion public listing in the next 12 months the alt-meat giant looks set to cause serious market disruption with an upcoming launch into Australia and New Zealand. Please send me emails about Impossible Foods products and services.

How can I invest. I sincerely doubted anyone was cold calling me for anything that was a good idea and definitely not anything thats going to be profitable for me so basically just hung up. Impossible Foods IPO got my details from CommSec apparently.

Today Patrick Brown steps down as CEO of Impossible Foods the plant-based protein juggernaut he founded in 2011. The reports come as the Silicon Valley food techs founder and. With the recent round of funding this week and the addition of a prominent female board member It seems to me like Impossible Foods is preparing for an IPO.

Founded in 2011 Impossible Foods is one of the leading producers of plant-based hamburgers and meat substitutes. Peter McGuinness former president and chief operating officer at yogurt brand Chobani has taken the reins. Palantir just didnt the same before filing with the SEC.

Impossible Foods has already announced its plans to go public in the US with a US10 billion IPO. In 2018 the industry generated 42 billion in revenues and that figure is expected to reach 61 billion at least by 2023. Like most of the 150-plus employees at the Silicon Valley headquarters of Impossible Foods David Lee often partakes of the vegan breakfast and lunch served daily in one of the companys quirkily named meeting rooms Ketchup Narwhal Zeep.

However all signs point to a profitable future which leaves investors hoping for. Impossible Foods is reportedly looking to raise 500 million in a new funding round that would bring its valuation to 7 billion. Alt Protein Future Foods.

Mushroom-based meat brand Fable Food and plant-based burger marker v2food are some of the existing players. But its not going to the public. The much-anticipated introduction of its famous heme-filled patties in the fast-growing plant-based market in Australasia comes amid talks of its US10 billion IPO.

Impossible Foods has secured 500 million in a new funding round led by existing investor Mirae Asset Global InvestmentsOther existing investors unnamed at this time also participated. Can you help with my student project. Buy Impossible Foods Stock After it Begins Trading.

IMPOSSIBLE FOODS DONATES ITS MILLIONTH BURGER AND DOUBLES DOWN ON SOCIAL GOOD FOR 2021. By Sally Ho Published on Nov 8 2021 Last updated Nov 6 2021. Revenues are expected to reach 125 million in 2019 up 400 from 2018 and could surpass.

Food tech giant Impossible Foods is now advertising for a new Australia and New Zealand Country Manager role on LinkedIn suggesting that the firm is gearing up to roll out its plant-based. But Lee isnt vegan. For the moment Impossible Foods revenues appear to be around 90 million per year and the company is not profitable yet.

Manhattan Street Capital best known for its Reg A securities offerings is pitching shares in Impossible Foods a competitor to Beyond Meat NASDAQBYND. One such company Impossible Foods Inc is reportedly planning to enter Australia New Zealand markets soon. There are three ways you may be able to acquire shares of an IPO stock such as Impossible Foods.

Mostly known for its Impossible Burger distributed in both restaurants and fast food outlets such as Burger King and White Castle Impossible Foods is growing quickly. April 4 2022. The stock still trades below its IPO price of 35 per share.

California law requires at least one female board member in order for a company based in California to go public. If Im located outside of the United States I consent to my information being transferred to Impossible Foods in the United States. Impossible Foods latest funding round gave it a valuation of 403 billion in.

Tech Crunch recently interviewed Impossible Foods executives about the potential of a near-term IPO. While most competitors dont use synthetic ingredients to create their plant-based products Impossible Foods is solely focused on the genetic modification of ingredients and proteins to make fake. Impossible Foods does have hugely ambitious goals that require a lot of resources.

Do you have a digital media kit. It is a direct rival to the US-based firm Beyond Meat. Asked onstage how Impossible Foods will get the money to achieve its goals as a company and if that meant an IPO was coming soon the exec agreed that yes.

The move follows positive news from the countries joint food standards agency as it passes the use of a key ingredient in the companys alt-meat. Impossible Foods Eyes 7B Valuation Founder Hints At Inevitable IPO. It brings the US companys total funding close to 2 billion according to a press release and values the company at 7 billion according to reports.

Impossible Foods valuation is 4 b.

Impossible Foods Prepping To Go Public At 10bn Valuation Report

Impossible Foods Ipo How Soon Can You Buy The Vegan Company S Stock Youtube

Beyond Meat Competitor Impossible Foods Is Readying Its Ipo Sources Say The Motley Fool

Beyond Meat Continues To Sizzle Announces Ipo

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo

Impossible Foods Ready To Launch And Disrupt In Australia Ahead Of 10 Billion Ipo Vegconomist The Vegan Business Magazine

Impossible Foods Eyes 7b Valuation For Inevitable Ipo

E U Says Veggie Burgers Can Keep Their Name Published 2020 Veggie Burger Burger Veggies

Impossible Foods Signals Australia New Zealand Market Entry Amid Ipo Buzz

Impossible Foods Ipo Possible Scam Ozbargain Forums

Food Brands That Experts Predict Could Go Public Alongside Impossible Foods

Impossible Foods Reportedly Preparing For Ipo With Us 10 Billion Valuation

Impossible Foods Ready To Launch And Disrupt In Australia Ahead Of 10 Billion Ipo Vegconomist The Vegan Business Magazine

Impossible Foods Raises 500m On Road To Possible Ipo

Impossible Foods Eyes 2022 Ipo Amid Heavy Demand Market Values

Beyond Meat Was The Vegan Ipo You D Been Waiting For But It Won T Be The Last Of Its Kind The Motley Fool

Exclusive Impossible Foods In Talks To List On The Stock Market Sources Reuters

Impossible Foods Ipo Finally On Cards All You Must Know

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo